What is ESG?

Value-based investing refers to the idea that investors should consider financial returns and philanthropic ideals when deciding where to invest. Value-based investing provides parameters for which companies should be excluded or pursued in the decision to invest. ESG, a value-based investment method that stands for environmental, social, and governance investing, has been a hot topic for Wyoming decision-makers.

ESG guidelines offer a metric system that can be used to determine a company’s sustainability based on its environmental, social, and governance policies. Investors then make a decision to invest based both on financial returns and their policies surrounding ESG. One of the most famous examples of this type of decision occurred in 2020: Patagonia refused to continue buying cotton products from China because of allegations of forced labor and human rights violations.

However, socially responsible investment policies were in place long, long before that. In the 1960s, investors excluded companies that had involvement with the South African apartheid due to social concerns.

ESG in Wyoming

In 2020, President Donald Trump and the Department of Labor blocked ESG considerations in investments for retirement plans by requiring investors to consider financial interest over any “non-pecuniary” ideals. Under President Joe Biden, the Department of Labor reversed this rule which has sparked anti-ESG efforts among many states.

In the 2023 General Session, the Wyoming Legislature attempted to pass two anti-ESG bills, SF159 and SF172. If these bills had passed, companies would have been disallowed to consider any ESG metrics when deciding where to invest. Perhaps unintentionally, this would have restricted Wyoming from investing in many companies for reasons as simple as a diversity statement on the company website.

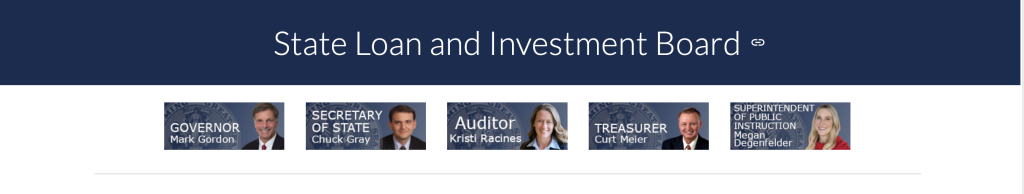

Over the summer, the State Loan and Investment Board (SLIB) approved a new policy that will require the disclosure of ESG principles for a company doing business with our state. In the August SLIB meeting, the Secretary of State and the Board were concerned that the usage of ESG policies would Wyoming by investors excluding its main industries– oil, gas, and coal.

Conor Mullen from the Sierra Club, has a different take on the situation:

“Anti-ESG policies such as the proposed amendments to the Securities Rules, make it more difficult for Wyoming to seek higher returns on investments. They restrict the information responsible investors use to assess risk–whether that pertains to the energy sector or otherwise. For this and other concerning reasons, numerous anti-ESG related bills have failed at the Wyoming State Legislature. Decision makers have recognized that outlawing responsible investment strategies is a ban on the freedom and duty of investors to account for risk and thus a ban on best practices.”

Conor Mullen, Sierra Club

The Secretary of State’s office has also requested a rule that mimics the SLIB rule, except it would also require investment brokers, broker-dealers, and securities agents who are working within Wyoming to disclose the usage of ESG principles.

The Wyoming Coalition for Healthy Retirement’s Judy Trohkimoinen has concerns about the recent commotion around ESG:

“We are very concerned about any ESG legislation or rules because they are likely to have a negative impact on Wyoming’s investments. In speaking with the Wyoming Retirement System, their belief is that their fiduciary duty is to make sure investments are stable, secure, and earning the maximum yield they can. Politics should have nothing to do with that process.”

Judy Trohkimoinen, Wyoming Coalition for Healthy Retirement

These proposed rules are up for public comment by the Secretary of State’s office. To view and comment, head to the Administrative Rules site. Click on “Proposed Rules”, scroll down to “Secretary of State (002)”, and click on “Securities”. The rules titled Chapter 4: Broker-Dealer Regulations, Chapter 5: Securities Agent Regulations, and Chapter 10: Investment Adviser Regulations all relate to the disclosure of ESG principles.

You can email Joe Rubino at joerubino1@wyo.gov to submit public comments on any of these rules. Public comment closes on Sept. 29th. Make your voice heard!

Interested in more information on ESG? Watch our panel from May.

Support:

Support:  Concerns:

Concerns:  Concerns:

Concerns:  Concerns: Hand-counting is expensive, people-intensive, time-intensive, and inaccurate. The Equality State Policy Center has laid out the reasons to keep our ballot machines, which are accurate, timely, and well-tested.

Concerns: Hand-counting is expensive, people-intensive, time-intensive, and inaccurate. The Equality State Policy Center has laid out the reasons to keep our ballot machines, which are accurate, timely, and well-tested. Concerns:

Concerns:  Support:

Support:  Concerns:

Concerns:  Support:

Support:  Concerns:

Concerns:  Support:

Support: