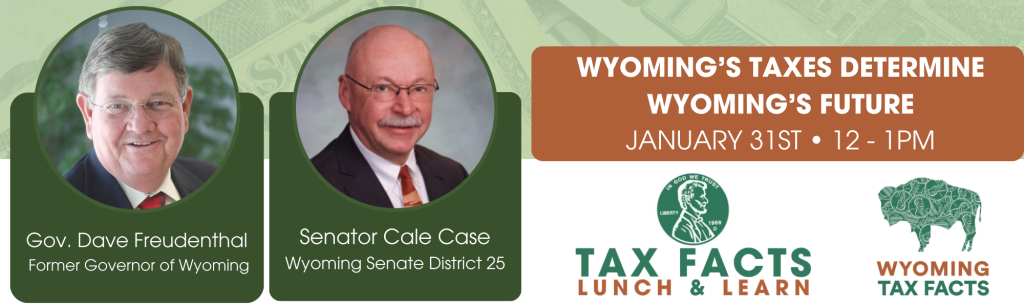

CHEYENNE, Wyo — On Wednesday, January 31, grassroots initiative Wyoming Tax Facts will host a Tax Facts Lunch & Learn webinar on Wyoming’s tax structure with Former Governor Dave Freudenthal—author of the recent book “Wyoming: The Paradox of Plenty”—and Wyoming Senator Cale Case, former Chairman of the Senate Revenue Committee. Moderated by Sue Sommers, the Zoom webinar will take place from noon to 1 pm and is free to anyone who registers at www.equalitystate.org/tax

Join us for a lively Q&A on the thorny topic of taxes, with two of Wyoming’s most learned leaders!

This session builds on our October 2023 Tax Facts Lunch & Learn webinar that featured a deep dive into our state’s property taxes with Revenue Director Brenda Henson Watch that recording at https://www.youtube.com/watch?v=waso_HNDuao.

How property taxes are assessed, and what services they pay for, is a hot topic in state news, and a powerful theme in Gov. Freudenthal’s book, which interrogates the role the minerals industry has played in Wyoming’s revenue stream.

Sen. Case, an economist with 16 years on the Wyoming Legislature’s Revenue Committee, understands and can speak to this scenario in detail. Both men view our reliance on minerals to support the state’s budget as unsustainable, and contrary to Wyoming’s independent, community-centered spirit.

“Governor Freudenthal shows how Wyoming’s economy has always been driven by federal policies and outside influences,” says Sen. Case. “The minerals and electricity sectors have enabled the Legislature to reduce the tax burden on most taxpayers. As an extractive economy in a changing world, Wyoming needs to find a tax structure that will nurture a robust economic future and support our state for the next 50 years.”

The former Governor adds, “Savings funds do not build the state. Taxes build the state. We need to think about our obligation to the future; not our obligation to ourselves.”

Marissa Carpio, policy director for the Equality State Policy Center, says that the Wyoming Tax Facts education mission dovetails with ESPC’s focus on transparency and thriving communities. “We are fortunate to have the opportunity to work with Wyoming Tax Facts and other partners to provide non-partisan conversations around taxes,” she says. “How we raise and spend tax dollars says a lot about who we are as Wyomingites.”

Find recorded Tax Facts Lunch & Learn webinars, and other Equality State Policy Center webinars, on YouTube at https://www.youtube.com/@theequalitystatepolicycent5729.

###

Wyoming Tax Facts is a grassroots coalition of Wyomingites committed to a stable economic future by increasing tax literacy in our communities and promoting tax reform. Wyoming Tax Facts is a sponsored project of the Wyoming Community Foundation.

For over 30 years the Wyoming Community Foundation (WYCF) has connected people who care with causes that matter to build a better Wyoming. WYCF has granted more than $100 million to charitable causes while also providing a variety of supports to nonprofit agency fund holders.

The Equality State Policy Center is a coalition of social justice, labor, and conservation groups working to improve the lives of all Wyoming’s people through transparent government, fair elections, and thriving communities. For more information, visit equalitystate.org.

Support: Supporting this resolution aligns with our commitment to fair elections by ensuring that the voices of everyday citizens are not drowned out by unlimited spending from wealthy special interests. The rising costs of campaigns, reflected in ESPC’s recent campaign finance reports, make it harder for ordinary people to run for office and for voters to have an equal say with their dollar power. Agree?

Support: Supporting this resolution aligns with our commitment to fair elections by ensuring that the voices of everyday citizens are not drowned out by unlimited spending from wealthy special interests. The rising costs of campaigns, reflected in ESPC’s recent campaign finance reports, make it harder for ordinary people to run for office and for voters to have an equal say with their dollar power. Agree?  Concerns: Masquerading as a transparency bill, this bill shoves together many components of other bills we oppose. Despite the lack of evidence that we have an issue with voter fraud in our state, this bill imposes unnecessary barriers and opens our processes up to errors.

Concerns: Masquerading as a transparency bill, this bill shoves together many components of other bills we oppose. Despite the lack of evidence that we have an issue with voter fraud in our state, this bill imposes unnecessary barriers and opens our processes up to errors. ESPC Concerns: This bill creates a $2 million fund for runoff election costs and increases candidate spending. We agree with the intent of this bill, however, we believe in saving money and increasing voter turnout. We think a bill like this should be implemented in a single election, with the top two vote-getters facing off in the General.

ESPC Concerns: This bill creates a $2 million fund for runoff election costs and increases candidate spending. We agree with the intent of this bill, however, we believe in saving money and increasing voter turnout. We think a bill like this should be implemented in a single election, with the top two vote-getters facing off in the General. Support:

Support:  Concerns:

Concerns:  Concerns:

Concerns:  Concerns: Hand-counting is expensive, people-intensive, time-intensive, and inaccurate. The Equality State Policy Center has laid out the reasons to keep our ballot machines, which are accurate, timely, and well-tested.

Concerns: Hand-counting is expensive, people-intensive, time-intensive, and inaccurate. The Equality State Policy Center has laid out the reasons to keep our ballot machines, which are accurate, timely, and well-tested. Concerns:

Concerns:  Support:

Support:  Concerns:

Concerns:  Support:

Support:  Concerns:

Concerns:  Support:

Support: